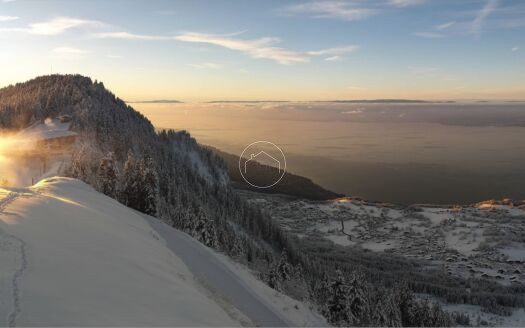

Domosno End Of The Year Ski Report 2023

As Domosno, the new-build ski property specialists for the French Alps, we’ve been closely monitoring the market trends over the past year. A year ago, we observed the unsustainable pace of price growth in mountain resorts globally, foreseeing a market bifurcation. Our forecast was accurate: while the ultra-prime segment continued to see price increases, there was a noticeable leveling in the mid to lower tiers.

Entering autumn 2023, the market landscape presents a more complex picture. The Bank of England’s recent decision to halt interest rate hikes, a move we anticipate being mirrored by the Federal Reserve and European Central Bank, introduces new variables. Higher interest rates have already impacted buyer enthusiasm in the Alps, particularly among investors. Yet, at Domosno, we’ve identified select areas like Saint-Gervais, where investment remains viable, with properties still available under 5,000€/sqm. However, the increased difficulty for British buyers to secure mortgages in France is an ongoing challenge. Through our trusted French mortgage brokers, we still facilitate mortgages, though rates have risen, especially for ski properties above 350,000€.

Domestic and European buyers continue to buoy the market, offsetting these challenges. For properties priced above €/CHF 3 million, the mortgage factor is less significant. Wealthier buyers, often less dependent on loans, have maintained their interest in alpine properties, supporting the ultra-prime market, where only a fifth have seen price declines.

Looking ahead, with looming government elections and ongoing global uncertainties, predicting market trends for the next year is more challenging. Our annual Ski Report delves into these dynamics, examining prime and ultra-prime prices in major ski resorts worldwide. It also explores the expansion of luxury retail in these locales and the latest developments in the Ski Resilience Index. We remain cautiously optimistic for the upcoming season and invite you to gain insights from our report.

The upcoming ski season is poised to be dynamic, shaped by evolving consumer preferences and lessons learned from the pandemic. Here’s an analysis of the key factors influencing the ski markets:

- Climate Change: The perception of diminishing snowfall due to climate change is prevalent, yet data from the northern French Alps (Savoie, Haute Savoie, Isère) suggests that the average number of days with more than 1 metre of snow at 1,800 metres has remained relatively stable since the late 1980s. Despite this, the concern for climate change is driving resorts to invest in snowmaking technology, maintaining their appeal by ensuring reliable snow conditions, especially at higher elevations.

- Prime Property Resilience: The prime residential market often shows resilience during economic uncertainty. Despite potential price fluctuations, prime properties are expected to continue outperforming mainstream properties. This segment’s strength is partly due to the nature of the buyers, who often purchase with cash, making French mortgages less relevant.

- Sustainability Focus: Sustainability is increasingly critical in the ski industry. Resorts are adopting strategies to mitigate environmental impacts, such as reducing energy consumption and promoting eco-friendly transport options like the Ski Train in Europe. Resorts that effectively communicate their sustainability efforts may gain a competitive advantage.

- Buyer Behavior Shifts: In the prime ski market, purchases are usually less dependent on mortgages. However, with foreign buyer restrictions in top Swiss markets and in some European locations for non-EU buyers, there’s a shift towards rental options or purchasing in less restrictive areas. This could benefit alternative ski destinations.

- Regional Travel Trend: The preference for local and regional travel, reinforced during the pandemic, is likely to continue. Even with the return of international travel, many skiers are expected to explore destinations within easy reach by car, train, or short-haul flights, favouring accessibility and convenience.

Overall, these factors suggest a ski market that is adapting to both environmental and economic challenges, with a growing emphasis on sustainability and changing buyer behaviours.