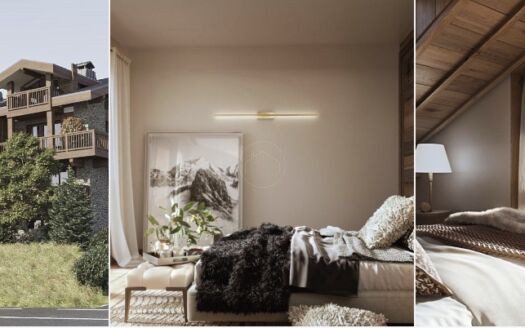

April 2025 French Mortgage – Key Highlights for UK Ski Property Buyers

In light of ongoing global economic uncertainties, including volatile stock markets, we are witnessing a notable rise in cash buyers opting for mortgage solutions to finance their French ski property acquisitions. This strategy serves not only to mitigate exposure to fluctuating exchange rates but also to preserve investment portfolios during turbulent market conditions.

Importantly, securing a French mortgage for a ski property need not delay your purchase. April has demonstrated that French mortgage offers can be issued within a mere month of application. Though we have observed an upward movement in some interest rates, financing remains highly competitive compared to UK and US domestic offerings.

Current French Mortgage Offers for Non-Resident Buyers Include:

Up to 85% Loan-to-Value (LTV) at a fixed 3.95% over 15 years

Up to 70% LTV at a fixed 3.20% over 15 years

For context:

Average 5-year fixed rate in the UK: 4.67% (Rightmove)

Average 15-year fixed rate in the US: 5.95% (Freddie Mac)

Recent Client Success Stories:

Courchevel: €3M purchase, 50% LTV at 3.95% fixed over 15 years, early repayment flexibility after 5 years, no life insurance required.

Morzine: €2.55M purchase, 75% LTV at 4.40% fixed over 18 years, purchased via a SARL, early repayment option after 7 years.

Saint-Gervais: €600,000 purchase, 63% LTV at 4.10% fixed over 20 years, British couple, no life insurance necessary.

Important Note:

Rates quoted in the press typically reflect conditions for French residents. Non-resident rates are inherently higher — please ensure clients are fully informed by referring to our latest figures.

We would be delighted to provide our ski property clients with a free, no-obligation personalised quote. For further details or to discuss a client’s profile, kindly contact us at info@domosno.com