Capital Gains Tax on French Properties

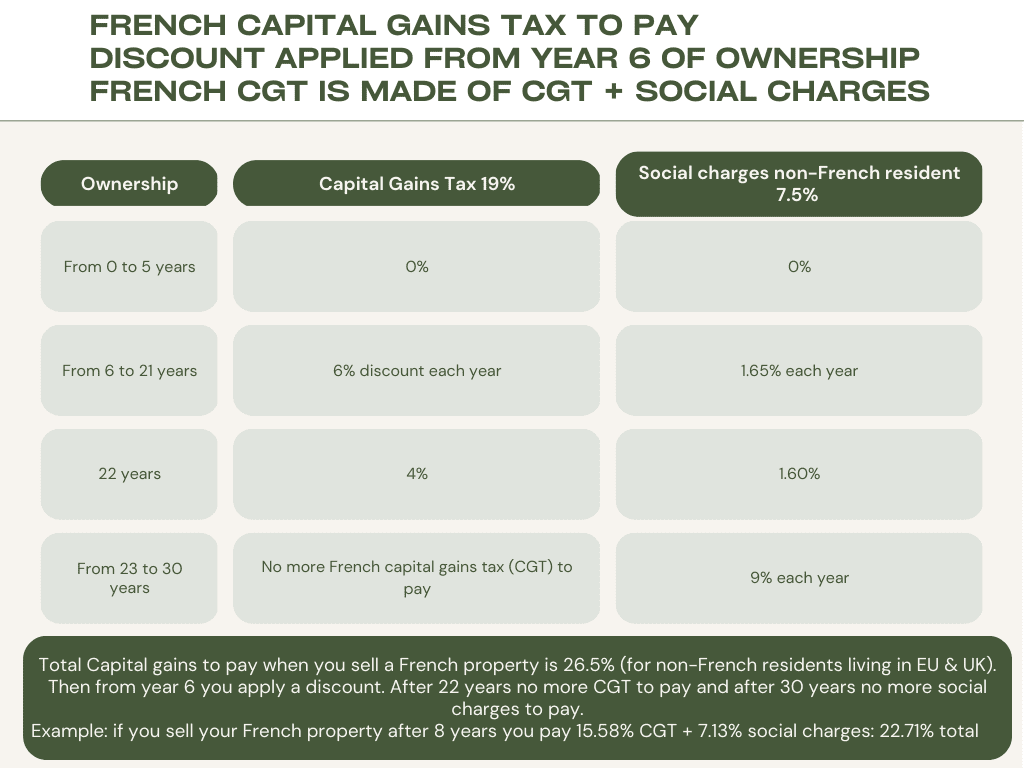

The taxation of capital gains on French properties is subject to changes due to reforms. Since January 1, 2018, they have been taxed at a flat rate of 19% for income tax and 7.5% for social security contributions (this 7.5% is for EU and UK residents. French residents pay 17.2%). An additional surcharge applies for high capital gains above 50,000€.

See our article on CGT tax in France for non residents

Which French properties are subject to capital gains tax?

Primary residences are always fully exempt like in the UK. The properties subject to capital gains tax include second homes, buy-to-let properties, vacant homes, commercial premises, land, and shares of SCPI or those held in an SCI.

What is the capital gains tax rate?

The net real estate capital gain (after deductions) is subject to a 19% flat rate income tax. In addition, social security contributions are levied at a rate of 7.5% (since January 1, 2018 for EU and UK non-French tax residents). This results in a total tax rate of 26.5%. Contact a French tax adviser for the latest as these values can change.

Capital gains are exempt after 22 years:

Income tax deduction for the holding period is 6% per year from the 6th to the 21st year and 4% for the 22nd year. However, social security contributions are still calculated over a 30-year period (that is between 10% and finally 0% in year 30.

Also check our articles on French tax for non residents.

Social security reductions for non French residents within the EU and the UK is only 7.5% instead of 17.2%. Please apply the calculation accordingly.

Example French Capital Gains Tax Calculation On Selling

High Capital Gains Tax In France, 2-6% added

In case of joint sellers of a french property (married or civil union couple, cohabiting partners, or any other joint owners), the 50,000 euros capital gains threshold is assessed individually based on the share held by each person in the property sold.

A married couple sells a French property belonging to them. The net taxable capital gain is 90,000 euros. The share of the capital gains tax to each spouse is 45,000 euros. The spouses are, therefore, not liable on the high capital gains tax since each of their shares is below the 50,000 euros tax threshold.

Surcharge on High Capital Gains Since January 1, 2013, a surcharge of 2% to 6% is added to the tax on real estate capital gains when they exceed 50,000 euros. It is calculated on the total amount of the taxable capital gain, potentially reduced by the deduction for the holding period.

It applies to capital gains from the sale of French properties excluding building plots (and tax-exempt sales of capital gains, such as the main residence).

Comparing capital gains Tax France vs UK

In comparison to France, the United Kingdom also imposes a capital gains tax on residential properties. In the UK, the tax rates are different for basic-rate taxpayers and higher-rate taxpayers. Basic-rate UK taxpayers pay 18% on capital gains from residential properties, while higher-rate taxpayers pay 28%. There is also an annual tax-free allowance, known as the Annual Exempt Amount, which is £12,300 for the 2021/2022 tax year.

Unlike France, the UK does not have a surcharge on high capital gains, but it does not provide any holding period deductions.

The UK and France do offer some reliefs, such as Main Residence Relief for primary homes, which exempts the property from capital gains tax. Overall, the capital gains tax systems in both countries have their unique characteristics, with France having a higher flat rate and surcharge on high gains, while the UK has variable rates based on the taxpayer’s income tax bracket and an annual tax-free allowance.

The French GPT system is better for long-term property ownership. After 7 years of owning a property, you will be better off in France than in the UK if you are a higher-rate UK taxpayer (28% CGT in UK). Even for short term investment the French tax system can be better than in the UK with CGT tax + social charges totalling only 26.2% compared to higher-rate tax payers in UK with 28%.

Capital Gains Tax (CGT) in France is generally considered more favourable for long-term property investments due to the holding period deductions that it offers. These deductions reduce the taxable amount of capital gains as the holding period of the French property increases, ultimately encouraging long-term investments.

In France, there is a 6% deduction per year for income tax from the 6th to the 21st year of holding a French property, and a 4% deduction for the 22nd year. As a result, the capital gains tax on a property is fully exempt from income tax after 22 years of ownership. Moreover, there are also deductions for social security contributions, which are calculated over a 30-year period. After 30 years, the property is exempt from income tax and social security contributions on capital gains.

These holding period deductions, which reward long-term investments, make the French CGT system more advantageous for property owners who plan to hold their assets for an extended period. In comparison, other countries, like the UK, do not provide such deductions based on the length of property ownership.

Apr 14, 2023

French Capital Gains Tax for non-residents

Continue reading

Apr 14, 2023

French tax on property rentals for non-resid…

Continue reading

Apr 14, 2023

French tax on property rentals for non-resid…

Continue reading

Apr 01, 2023

Understanding Capital Gains Tax in France: A…

Continue reading

Mar 29, 2023

New energy standards for new-build propertie…

Continue reading

Mar 15, 2023

How to access French Revenue to make a tax p…

Continue reading

Mar 15, 2023

Paying Your French Property Tax Bill

Continue reading

Feb 04, 2023

Investment Structures for French Real Estate…

Continue reading

Dec 31, 2022

Get the Best of Both Worlds: Use Your Ski Pr…

Continue reading

load articles