Taxation of capital gains on French properties for non-residents

Table of Contents

As a non-French resident taxpayer, you are subject to the taxation of capital gains on real estate (profit left after making all the allowed deductions) when selling your French property. This is also true for shares of an SCI (Société Civile Immobilière) holding French properties (also family limited company).

What is a capital gain on a French property?

A capital gain on real estate is the difference between the sale price and the acquisition price of the property or shares. If the difference is positive (meaning you sell for more than you bought), the profit made is a capital gain. You also have deductions that you can make. See more info here.

How are capital gains on French property taxed for non-residents?

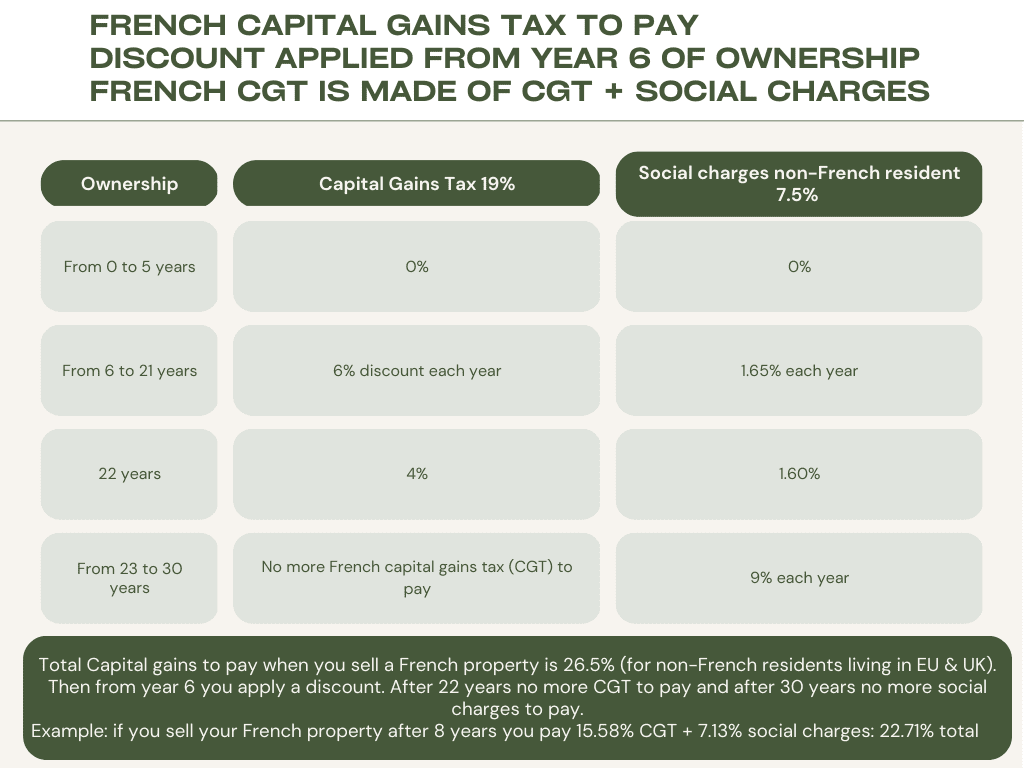

Capital gains (profit) on French properties made by non-residents are subject to a 19% withholding tax, regardless of the country of residence. Depending on your country of residence, you may also be liable for social security contributions (detailed explanations in the following paragraph).

To recap: French capital gains tax is 19% and reduces gradually from the 6th year of ownership.

As a non-resident, two situations entitle you to tax exemptions. Thus, you will not pay capital gains tax on real estate in the following cases:

- Sale of a primary residence in France: If the property was your main French residence just before your move abroad, you benefit from a total exemption. You are not required to file a declaration on capital gains tax. To be eligible, the sale must take place no later than December 31st of the year following the transfer of tax residence.

- Capital gains on real estate less than €150,000: The portion of the capital gain below €150,000 is exempt from taxation if you were a French resident during the last two years preceding the sale of the property. Additionally, the sale must take place no later than December 31st of the tenth year following the transfer of tax residence (5 years after for sales made before January 1st, 2019).

Social security contributions to add to capital gains calculations for non-residents

Which non-residents are exempt from social security contributions when calculating CGT in France?

Since January 1st, 2019, in terms of social security contributions, the rate of 17.2% is reduced to 7.5% if you are affiliated with a compulsory social security scheme other than French in an EEA country (European Union, Iceland, Norway, Liechtenstein) or Switzerland.

Although the United Kingdom left the European Union on January 1st, 2021, British residents continue to benefit from this reduced rate of 7.5%.

On the other hand, if you reside in a country outside the European Economic Area (or Switzerland and the United Kingdom), you will have to pay social security contributions of 17.2% like a French resident.

Good to know: It is important to note that the payment of these social contributions does not provide you with French state health insurance coverage.

Good to know: if you are an EU or UK resident you only pay a rescued rate of social charges of 7.5% instead of 17.2% like a French resident or non-EU/UK resident!

Capital Gains Tax (CGT) exemptions for non-residents

How to declare an exemption from social security contributions?

To take advantage of this exemption (paying only 7.5% in social charges), you must check the following boxes on your 2042 C tax return in the “8-Divers” category:

8SH (declarant 1) 8SI (declarant 2). Then, specify in box 8RF the amount of income that is exempt from CSG and CRDS.

Good to know: Note that these exemptions are valid if your new country of residence is an EU member state or if it has signed an administrative assistance agreement with France like the United Kingdom for example.

Surcharge on High Capital Gains

Surcharge on High Capital Gains Since January 1, 2013, a surcharge of 2% to 6% is added to the tax on real estate capital gains when they exceed 50,000 euros. It is calculated on the total amount of the taxable capital gain, potentially reduced by the deduction for the holding period.

It applies to capital gains from the sale of French properties excluding building plots (and tax-exempt sales of capital gains, such as the main residence).

How do double taxation treaties (DDTs) benefit non-residents?

DTTs (double-taxation treaties) can benefit non-residents in several ways, including:

- Eliminating or reducing withholding taxes on dividends, interest, and royalties.

- Providing tax credits for taxes paid in the other country.

- Defining the tax residency status of individuals and companies.

- Preventing discrimination against non-residents in tax matters.

To take advantage of a DTT (double-taxation treaties), you must provide the French tax authorities with a tax residency certificate from your country of residence. This certificate is usually issued by the tax authorities of your country of residence and should be attached to your French tax return.

DTTs (double-taxation treaties) can benefit non-residents in several ways, including:

- Eliminating or reducing withholding taxes on dividends, interest, and royalties.

- Providing tax credits for taxes paid in the other country.

- Defining the tax residency status of individuals and companies.

- Preventing discrimination against non-residents in tax matters.

- Tips for non-residents with French property

- Keep records: Maintain thorough records of your French property transactions, including purchase and sale documents, invoices for improvements, and any other relevant paperwork. These records will be crucial when calculating capital gains tax or claiming exemptions.

- Consult a tax professional: Tax laws can be complex, especially when dealing with international tax matters. Consulting a tax professional with experience in French and international taxation can help you navigate these complexities and ensure you are in compliance with all relevant laws.

- Understand your tax obligations: Be aware of your tax obligations as a non-resident with French property, including income tax, capital gains tax, IFI, and social security contributions. Stay informed about any changes in tax laws or regulations that may affect your situation.

- Plan for the future: Consider the long-term implications of your French property investments, including potential changes to your residency status, the impact of inheritance laws, and the possibility of selling the property in the future.

By understanding your tax obligations as a non-resident with French property and staying informed about relevant laws and regulations, you can better manage your investments and minimize your tax liability.

More articles about tax and regulations in France

Apr 14, 2023

French Capital Gains Tax for non-residents

Continue reading

Apr 14, 2023

French tax on property rentals for non-resid…

Continue reading

Apr 14, 2023

French tax on property rentals for non-resid…

Continue reading

load articles